Regarding the questionnaire:

https://forum.xx.network/t/help-shape-the-future-of-the-xx-network/7171/2

It’s good that the Foundation listens, but it’s sad that such low quality requests (to “add more exchanges”) is what surfaced and is being considered.

Such requests should be instantly dismissed and not even be considered. Everyone knows that on the whole, when everything else is the same more exchanges means less liquidity and worse quality-of-life for normal users and regular validators.

I noticed the questionnaire asks about market making, presumably because the whiners calling for “more exchanges” also want the Foundation to waste its funds not only on getting listed but also on funding market making so that these speculators can more easily offload whatever tokens they hold and want to sell. (If they didn’t wan to just sell, but also buy, they could easily market-make on their own.)

One thing that wouldn’t stay the same with the token listed on more exchanges would be more people would get the chance to buy xx and sit on it. But that’s too little to matter and useless in the big scheme of things. Considering the poor cost-benefit ratio, funds should instead be channeled in development of xxPostage and native DEX integration (more on that later).

I hope this will get easily rejected, but in the case it passes and funds get wasted despite everyone knowing it’s completely useless, I want to note here:

- Requests likely originate by traders/speculators and not chain users, regular validators, or even cMixx users and do nothing for the project

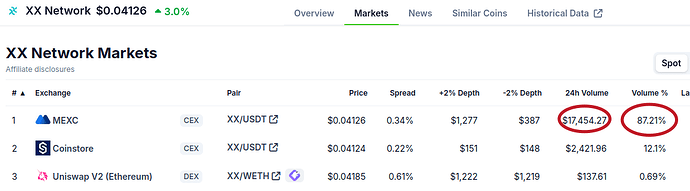

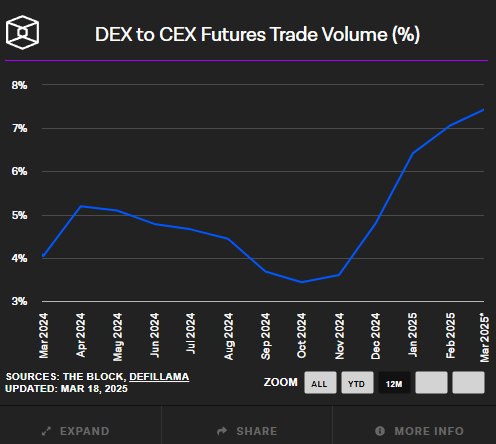

- There’s no need to add any exchanges when MEXC is easily approachable and the volume on DEXes is constantly growing. Adding additional CEX exchange means more cost and lower liquidity, so even more funds would be required (market making) to achieve absolutely nothing in return

- WXX has issues because it uses the sclerotic Ethereum L1. If the Foundation wants to invest, it should invest in a Substrate bridge that would not only enable native link to DEX on other Substrate chains (such as Polkadot, where they have stablecoins and whatnot and transactions are near-instant and cost next to nothing), but also half a dozen other use cases. But our traders have no idea about that or interest in anything except selling and speculating, so this doesn’t even come up in their tiny world.

If the Foundation decides to fund CEX waste, now I have an “I told you so” post to link to should that come to pass.